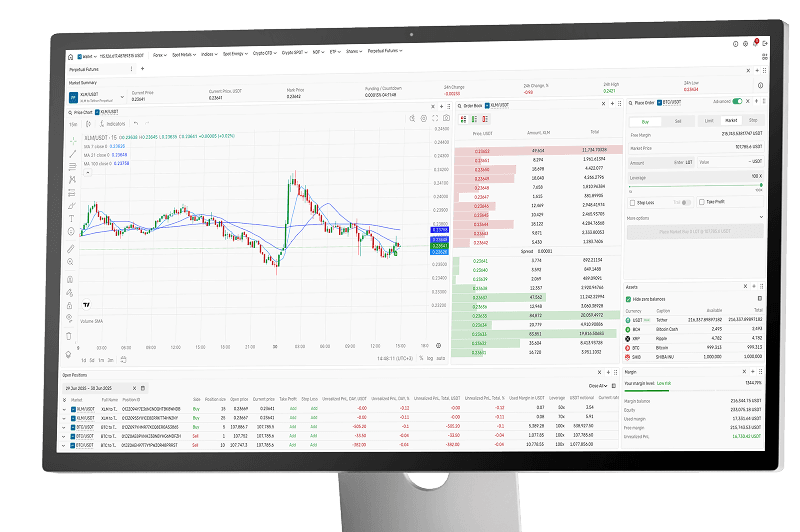

Supported Markets

Perpetual Futures trading provides traders with the ability to engage in futures contracts that do not have an expiration date.

or

This type of futures trading allows you to trade cryptocurrency price movements with the flexibility of holding positions indefinitely, leveraging their trades, and potentially benefiting from both rising and falling market trends.

Main Benefits of

Perpetual Futures

High Liquidity and Volume: smoother entry and exit points

As a popular derivative, crypto perpetual futures often feature high trading volumes and liquidity, ensuring efficient market participation.

Hedging Capability: manage crypto risk effectively

Perpetual futures provide a mechanism to hedge other crypto positions, helping to lock in profits or protect against adverse market movements.