For Crypto Brokers

DYNAMIC LEVERAGES. FLEXIBILITY IN EVERY TRADE.

The Dynamic Leverages functionality provides a flexible system for setting adjustable leverage levels in CFD and Perpetual Futures (PF) markets.

or

The Dynamic Leverages module allows brokers to define maximum leverage limits while offering traders the option to choose their leverage level based on trading strategies.

By tailoring leverage settings, this feature enhances both risk management and trading opportunities.

How Dynamic Leverages module Works

See how Dynamic Leverages give brokers control over limits while letting traders adapt leverage to their own strategies.

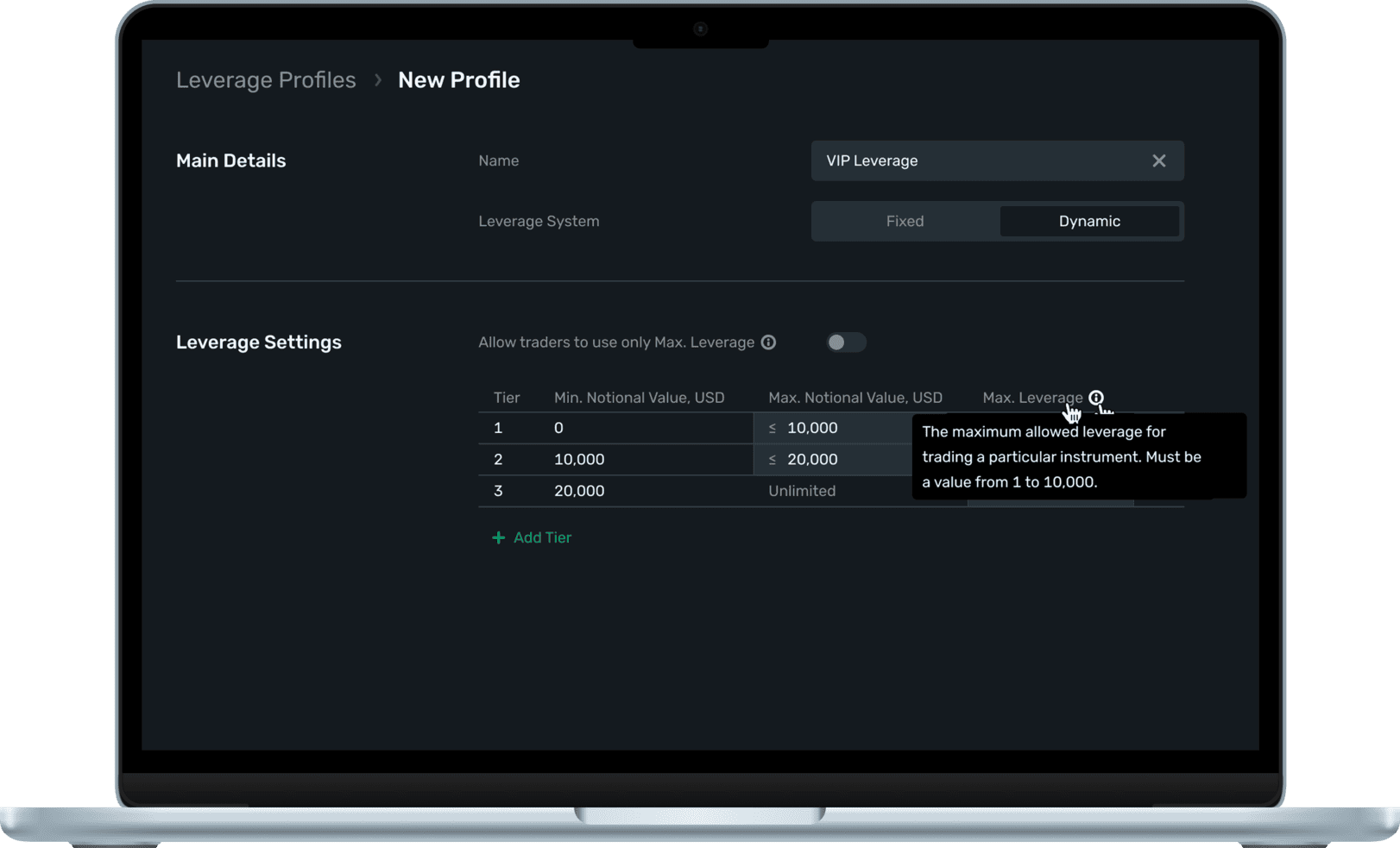

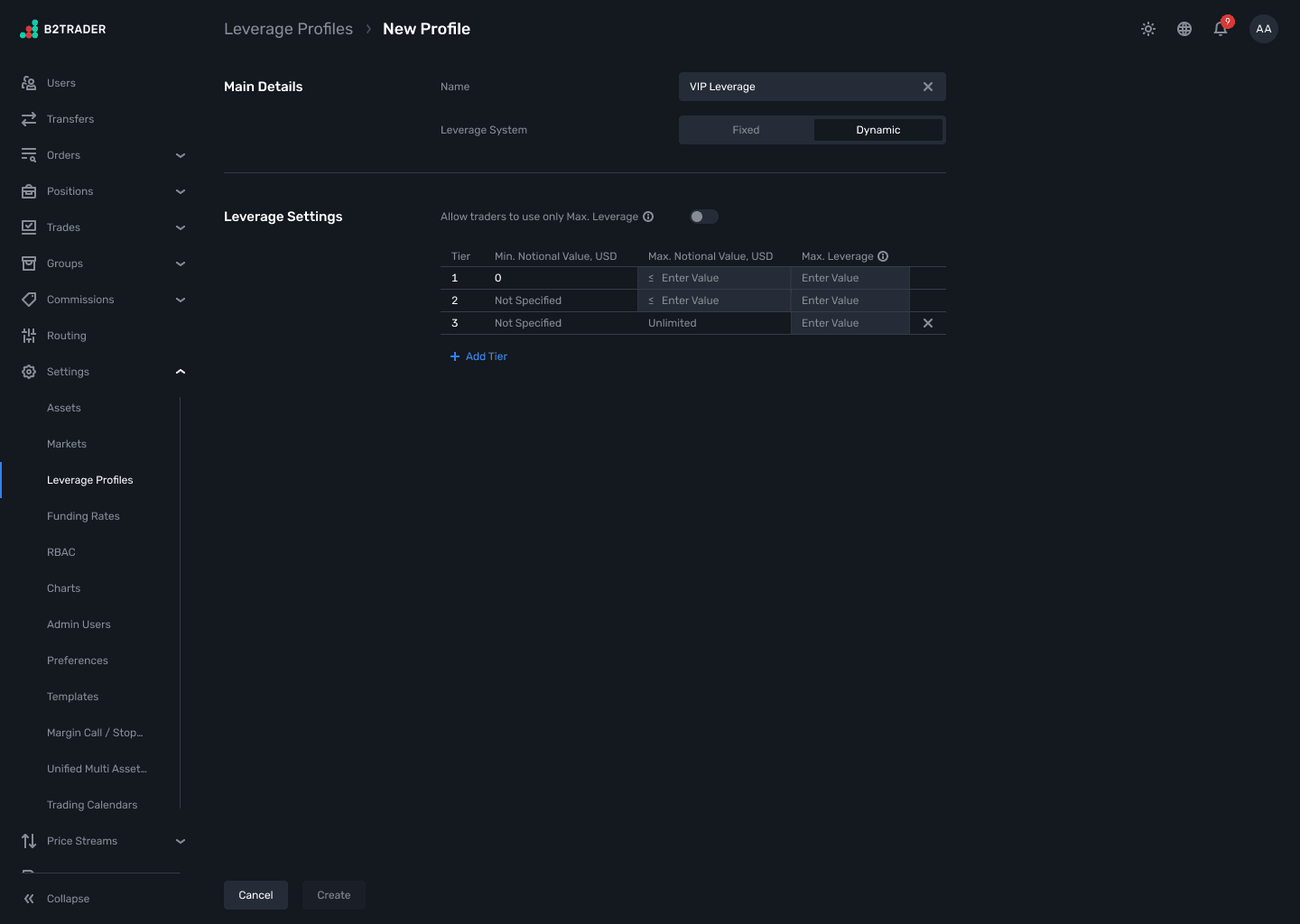

Maximum Leverage Definition

B2TRADER Admin sets the maximum allowable leverage for CFD and PF trading, enabling strategic control over trader exposure.

Trader Consideration

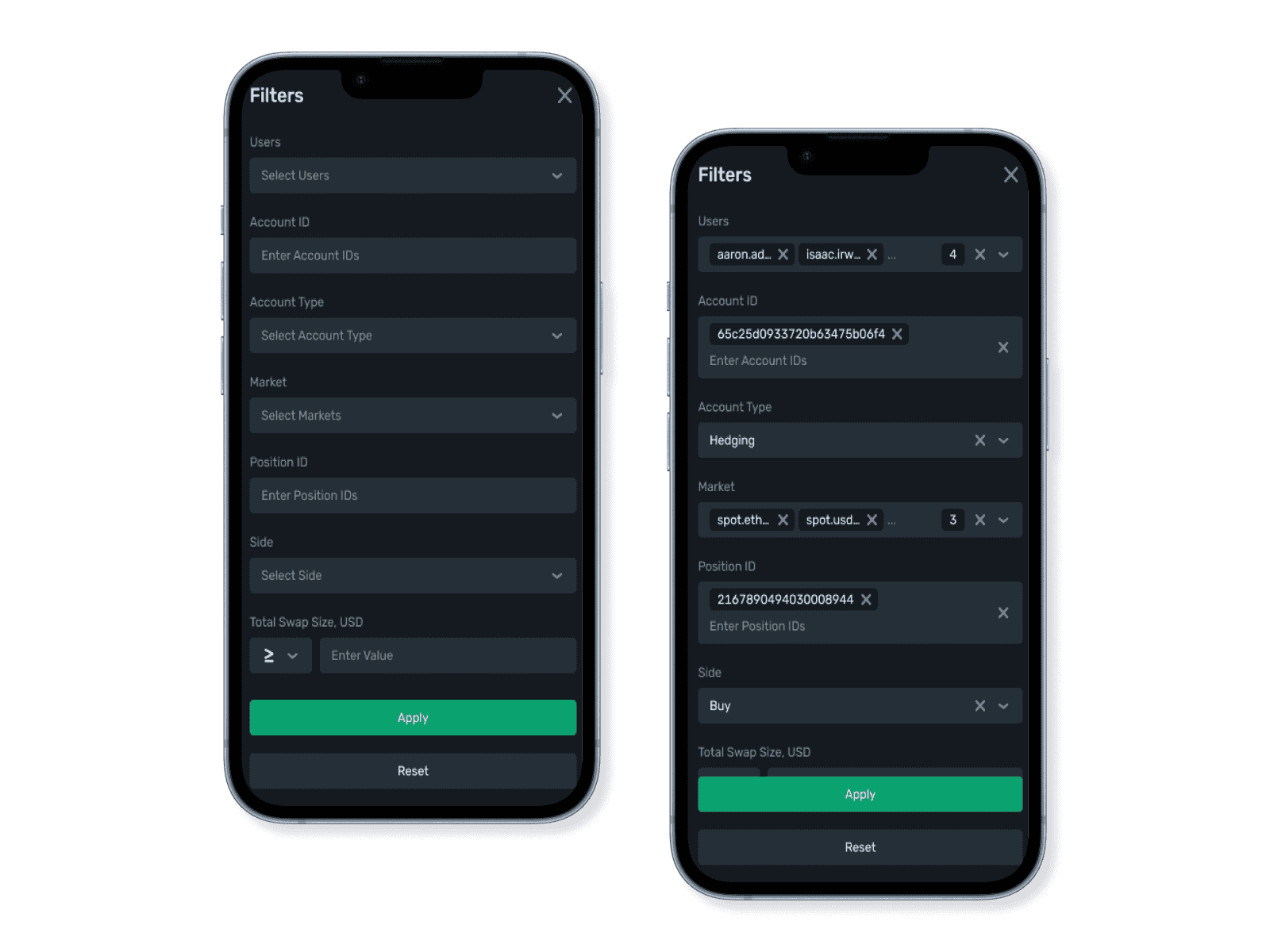

When allowed, traders can select leverage levels most suited to their risk appetite and market strategies, benefiting from tailored exposure.

Traders must use the maximum leverage set by the broker, enforcing a standardized trading condition.

Allows traders to choose a leverage ratio from 1:1 up to the maximum permitted, offering strategic flexibility.

OPPORTUNITIES OF USAGE

Discover how Dynamic Leverages boost risk control, strategy, and market appeal.

Admin-set maximum leverage limits help control risk exposure across all trading activities.

Traders can optimize their strategies by selecting a leverage level that aligns with their market analysis and risk management goals.

Providing leverage options can attract different types of traders, from conservative to aggressive, enhancing market participation.

Brokers can differentiate their offering with leverage flexibility, meeting varying trader preferences and regulatory standards.