Essentials for Brokers

SMART ROUTING & EXECUTION CONTROL

The Routing and Execution module in the B2TRADER system provides flexibility and control over how orders are processed and executed.

It supports three distinct order execution types A-Book, B-Book, and C-Book - allowing brokers to manage orders based on predefined parameters.

Customizable routing rules enable precise control over order execution, tailored to user categories, account traits, and market specifications.

Key Features

Key Features

From execution models to routing rules, the module ensures precision, speed, and flexibility in managing client orders.

From execution models to routing rules, the module ensures precision, speed, and flexibility in managing client orders.

Three Execution Models

A-Book: Executes the entire order amount with a liquidity provider.

B-Book: Internally executes the order amount within the broker platform, without external LP involvement.

C-Book (Hybrid): Splits the order amount, executing part on an LP and the remainder internally.

The price of the B-Book part is compared with the execution price of the A-Book part, guaranteeing the B-Book part isn’t executed with outdated outdated or less favorable quotes.

Three Execution Models

A-Book: Executes the entire order amount with a liquidity provider.

B-Book: Internally executes the order amount within the broker platform, without external LP involvement.

C-Book (Hybrid): Splits the order amount, executing part on an LP and the remainder internally.

The price of the B-Book part is compared with the execution price of the A-Book part, guaranteeing the B-Book part isn’t executed with outdated outdated or less favorable quotes.

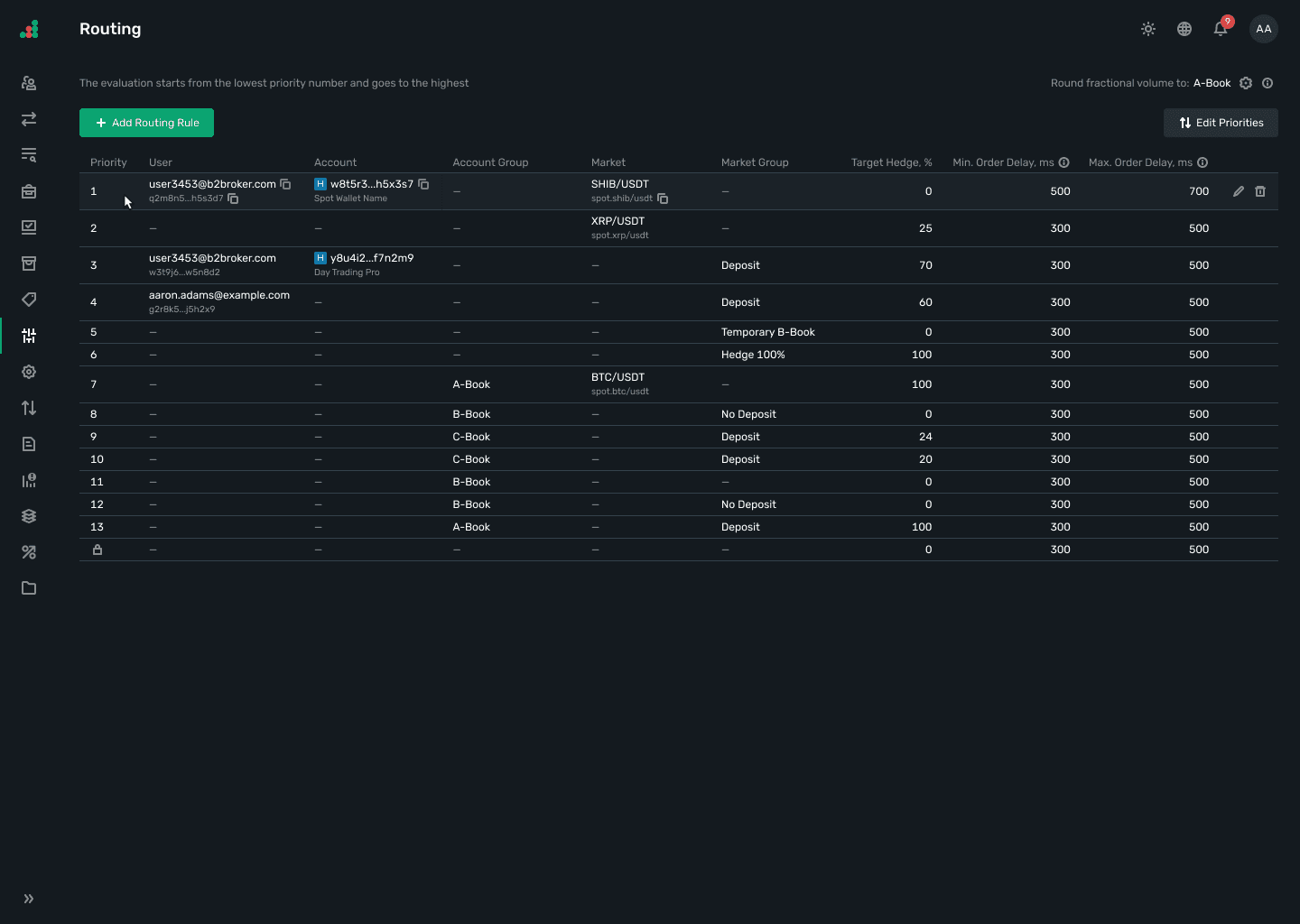

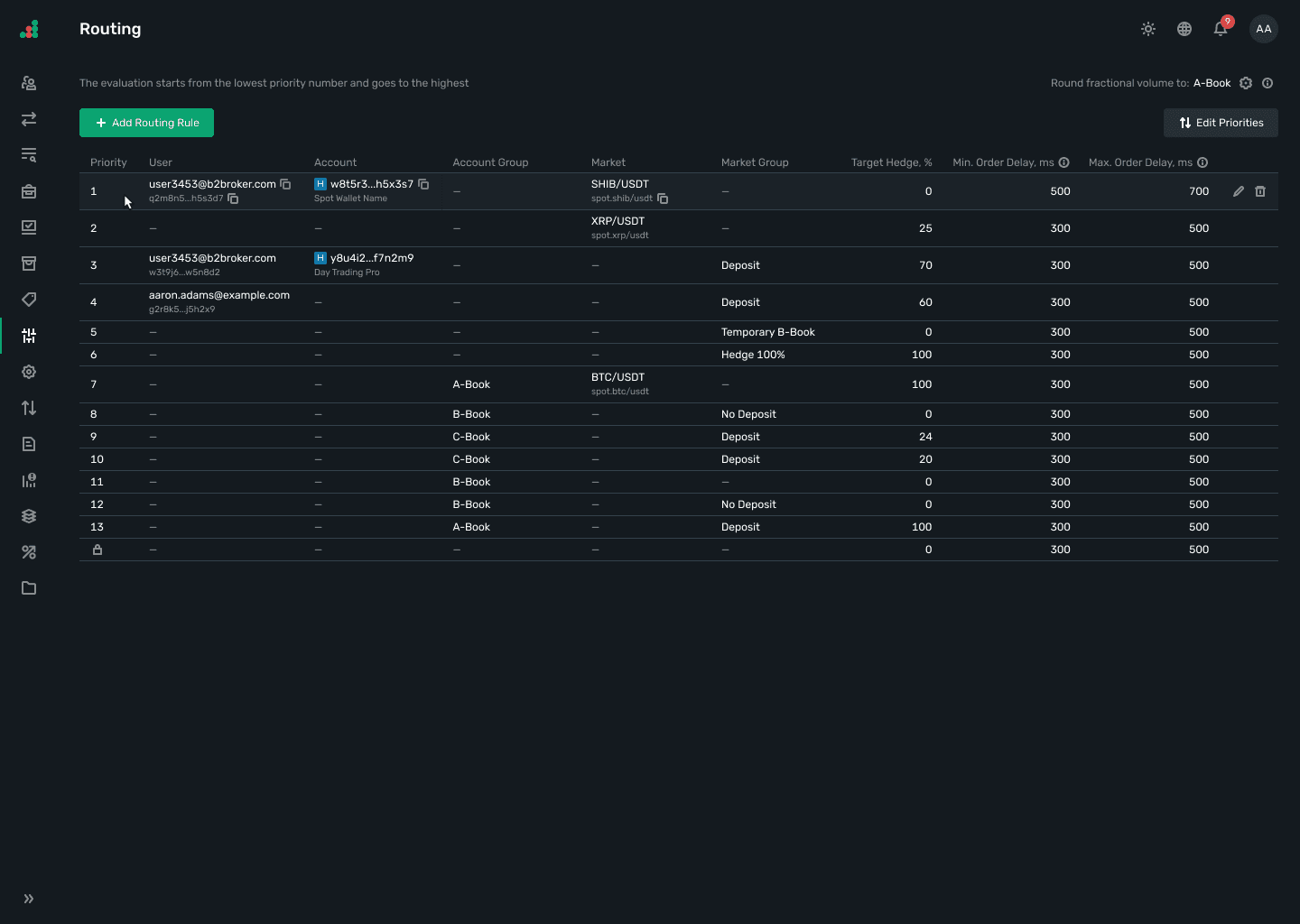

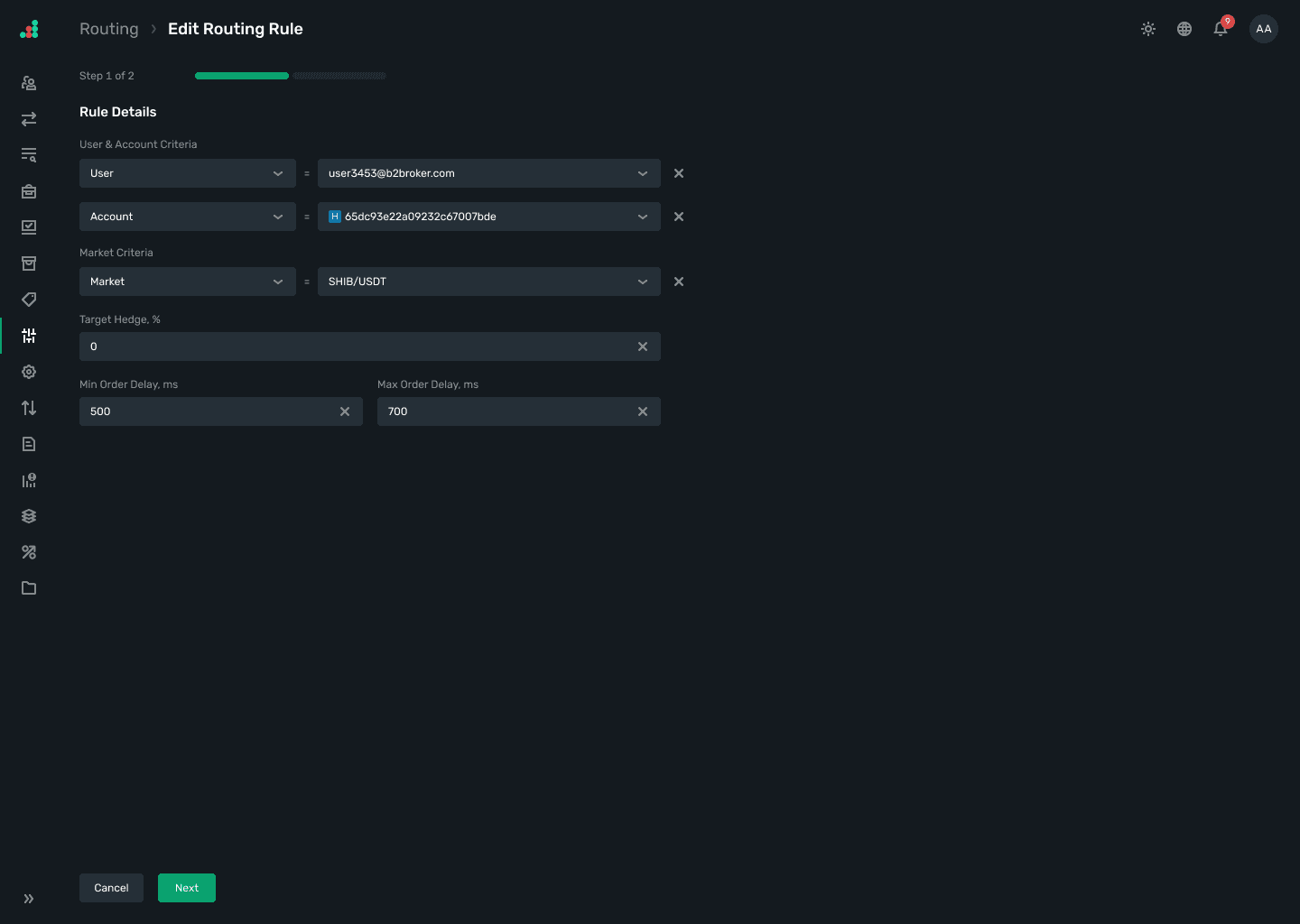

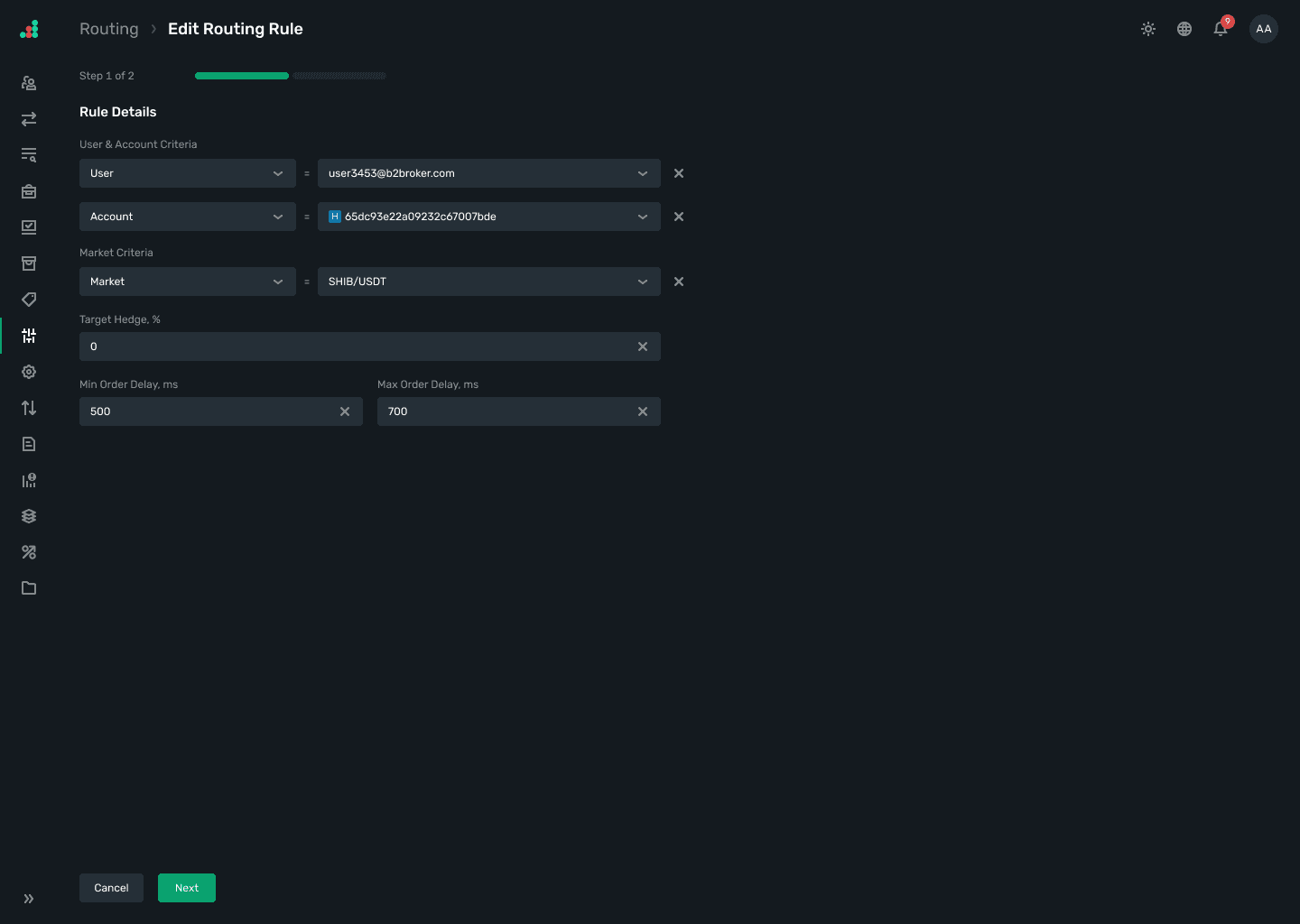

Customizable Routing Rules

Determine execution paths based on user, account, account group, market, and market group parameters.

Efficient Order Management

Ensures fast and optimized processing of trades according to pre-set brokerage rules.

Customizable Routing Rules

Determine execution paths based on user, account, account group, market, and market group parameters.

Efficient Order Management

Ensures fast and optimized processing of trades according to pre-set brokerage rules.

Execution Process

Execution Process

Order Execution

Type Selection

Determine based on the execution model (A-Book, B-Book, C-Book) and predefined routing rules.

Order Execution

Type Selection

Determine based on the execution model (A-Book, B-Book, C-Book) and predefined routing rules.

Order Creation

and Validation

Orders are submitted and validated for regulatory and brokerage compliance.

Order Creation

and Validation

Orders are submitted and validated for regulatory and brokerage compliance.

Risk

Management

Immediate checks follow to ensure risk parameters are met.

Risk

Management

Immediate checks follow to ensure risk parameters are met.

Routing

Matching

Orders approved post-validation and risk management are directed based on routing rules to liquidity providers or matched internally.

Routing

Matching

Orders approved post-validation and risk management are directed based on routing rules to liquidity providers or matched internally.

Order Execution

and Confirmation

Executed orders are confirmed and recorded, with critical details relayed back to the client.

Order Execution

and Confirmation

Executed orders are confirmed and recorded, with critical details relayed back to the client.

Market-Specific

Processes

CFD/PF positions impact margin and equity calculations; Spot transactions involve asset settlement.

Market-Specific

Processes

CFD/PF positions impact margin and equity calculations; Spot transactions involve asset settlement.

Record-Keeping

and Reporting

Executed trades are archived for compliance, and detailed performance reports are generated.

Record-Keeping

and Reporting

Executed trades are archived for compliance, and detailed performance reports are generated.

Flexible routing —

more business opportunities

Flexible routing —

more business opportunities

Discover the opportunities supported markets unlock — from stronger client engagement to expanded revenue potential.

Discover the opportunities supported markets unlock — from stronger client engagement to expanded revenue potential.

Optimized Execution Strategy

Tailors execution models to business and client needs, balancing risk, and maximizing profitability.

Risk Management

Effective control over how orders are executed and hedged, minimizing exposure and aligning with strategic objectives.

Operational Efficiency

Streamlined processes lead to faster execution and reduced costs.

Regulatory Compliance

Comprehensive order archiving and reporting ensure compliance with regulatory demands.

FREQUENTLY ASKED QUESTIONS

What are the different execution models supported?

A-Book, B-Book, and C-Book, each offering unique trade execution paths based on liquidity provider engagement and internal processing.

What are the different execution models supported?

A-Book, B-Book, and C-Book, each offering unique trade execution paths based on liquidity provider engagement and internal processing.

What are the different execution models supported?

A-Book, B-Book, and C-Book, each offering unique trade execution paths based on liquidity provider engagement and internal processing.