For FX CFD Brokers

MARKUPS. ADAPTIVE TO YOUR BUSINESS NEEDS

The Markups functionality in B2TRADER allows brokers to adjust the price streams available to traders by applying markups to the liquidity provider prices.

The Markups functionality in B2TRADER allows brokers to adjust the price streams available to traders by applying markups to the liquidity provider prices.

The Markups mechanism enables brokers to manage profit margins, customize pricing strategies, and tailor offerings to specific accounts or market conditions.

Through configurable markups, brokers have granular control over how prices are presented to their clients.

Vladimir Moshkov

Product Manager

“

“

“

How Markups mechanism works

See how Markups let brokers adjust price streams, apply flexible markups, and assign them to accounts with ease.

Configure Price Streams

Configure Markups

Assign Price Streams

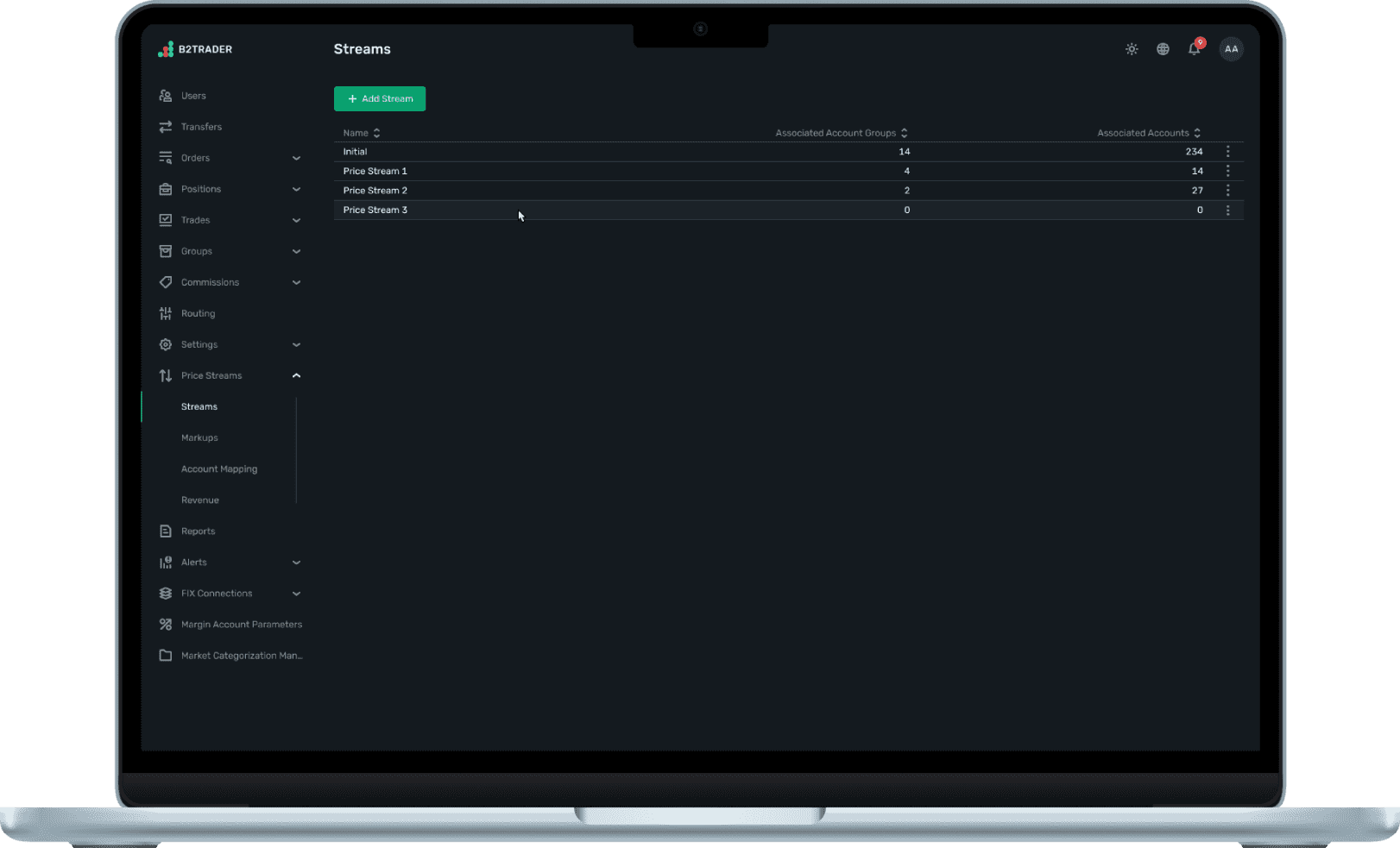

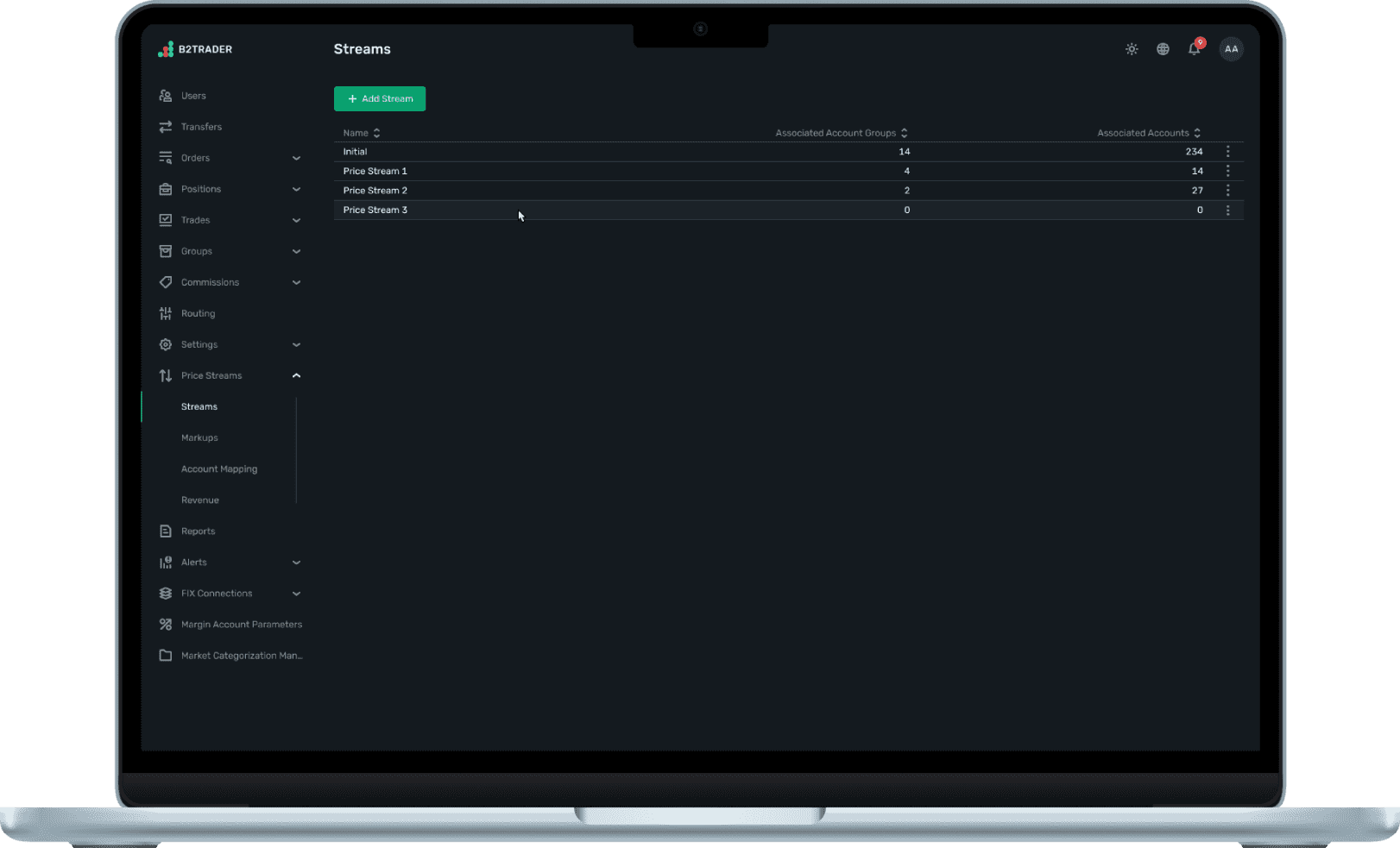

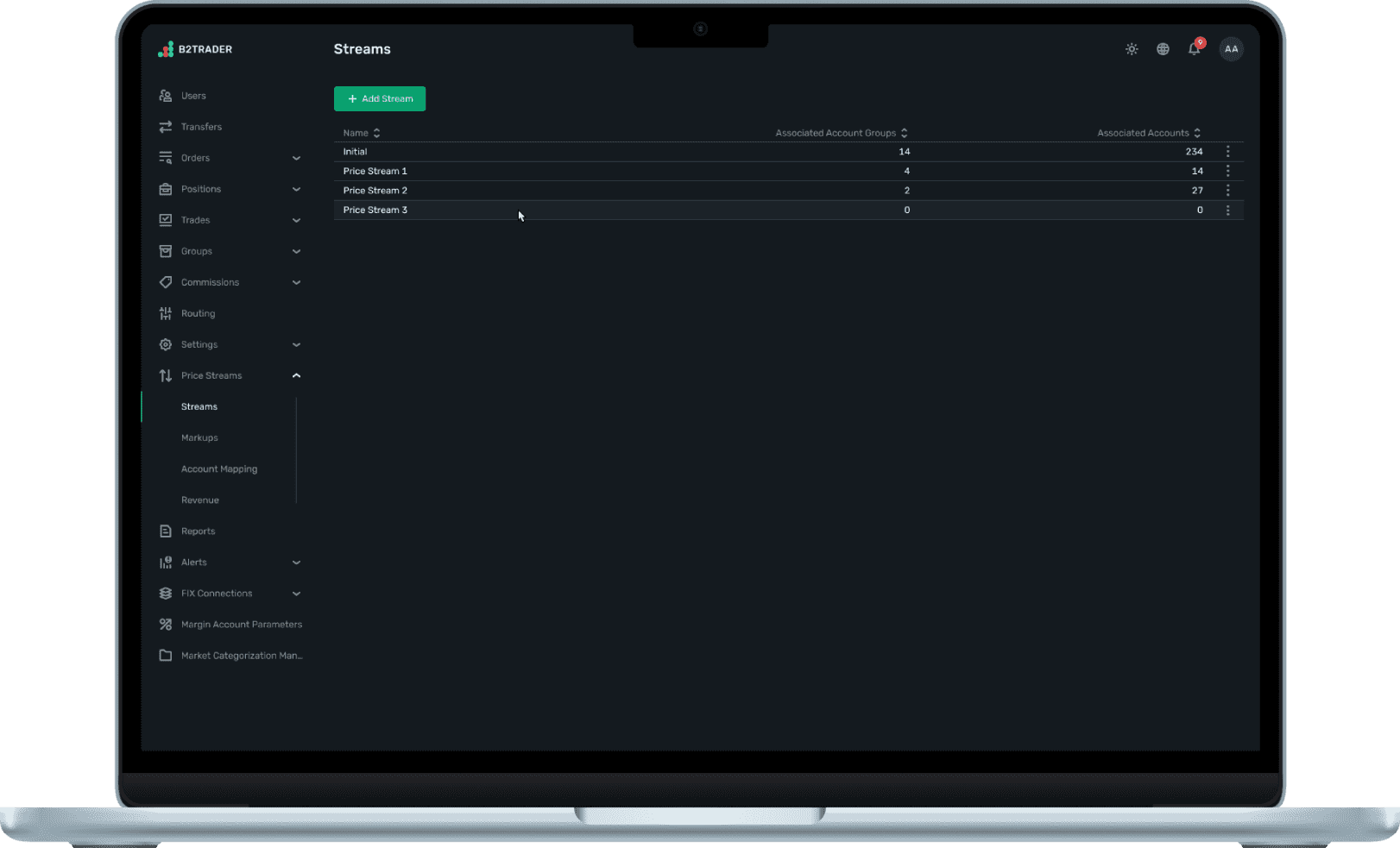

Initial Setup:

The system initializes with a default price stream with zero markups for all markets. Brokers can add new streams for precise control.

Creating New Streams:

Access Price streams

Streams

Click Add stream and select to either use default settings or copy settings from an existing stream

Name the new stream

Configure Price Streams

Configure Markups

Assign Price Streams

Initial Setup:

The system initializes with a default price stream with zero markups for all markets. Brokers can add new streams for precise control.

Creating New Streams:

Access Price streams

Streams

Click Add stream and select to either use default settings or copy settings from an existing stream

Name the new stream

Configure Markups

Initial Setup:

The system initializes with a default price stream with zero markups for all markets. Brokers can add new streams for precise control.

Creating New Streams:

Access Price streams

Streams

Click Add stream and select to either use default settings or copy settings from an existing stream

Name the new stream

Order Creation and Validation

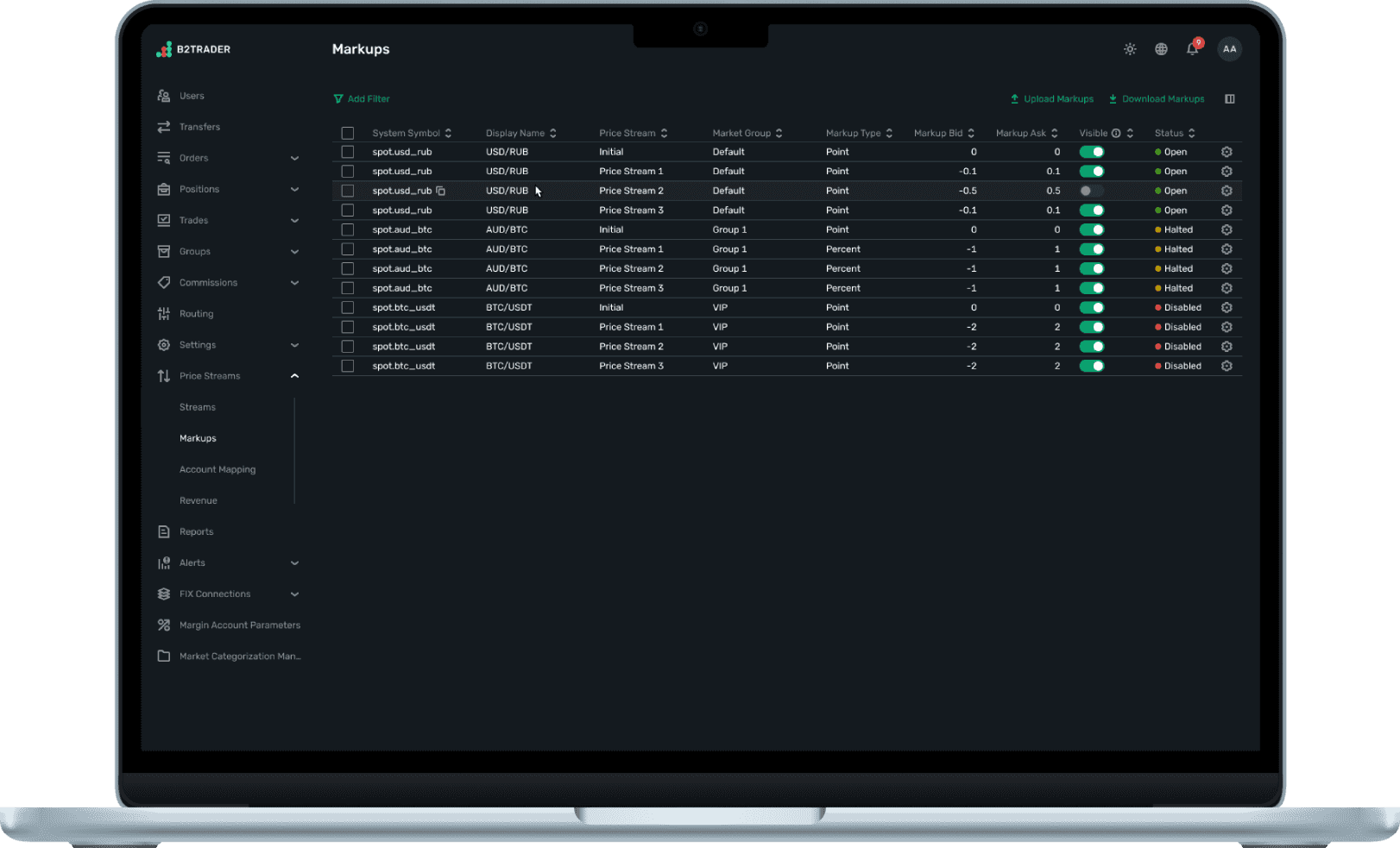

Access and Selection:

Navigate to Price streams

Markups, select the desired markets, and filter using the price streams as necessary

Editing Markups:

Choose between Percent or Points for markup type

Set bid and ask prices, adhering to possible markup value specifications

Decide market visibility in the Trading terminal (True/False)

Risk Management

To Account Groups

In Price streams

Account mapping on the Account groups tab

Assign a new price stream to an account group

For bulk actions, select multiple account groups and use the Edit function.

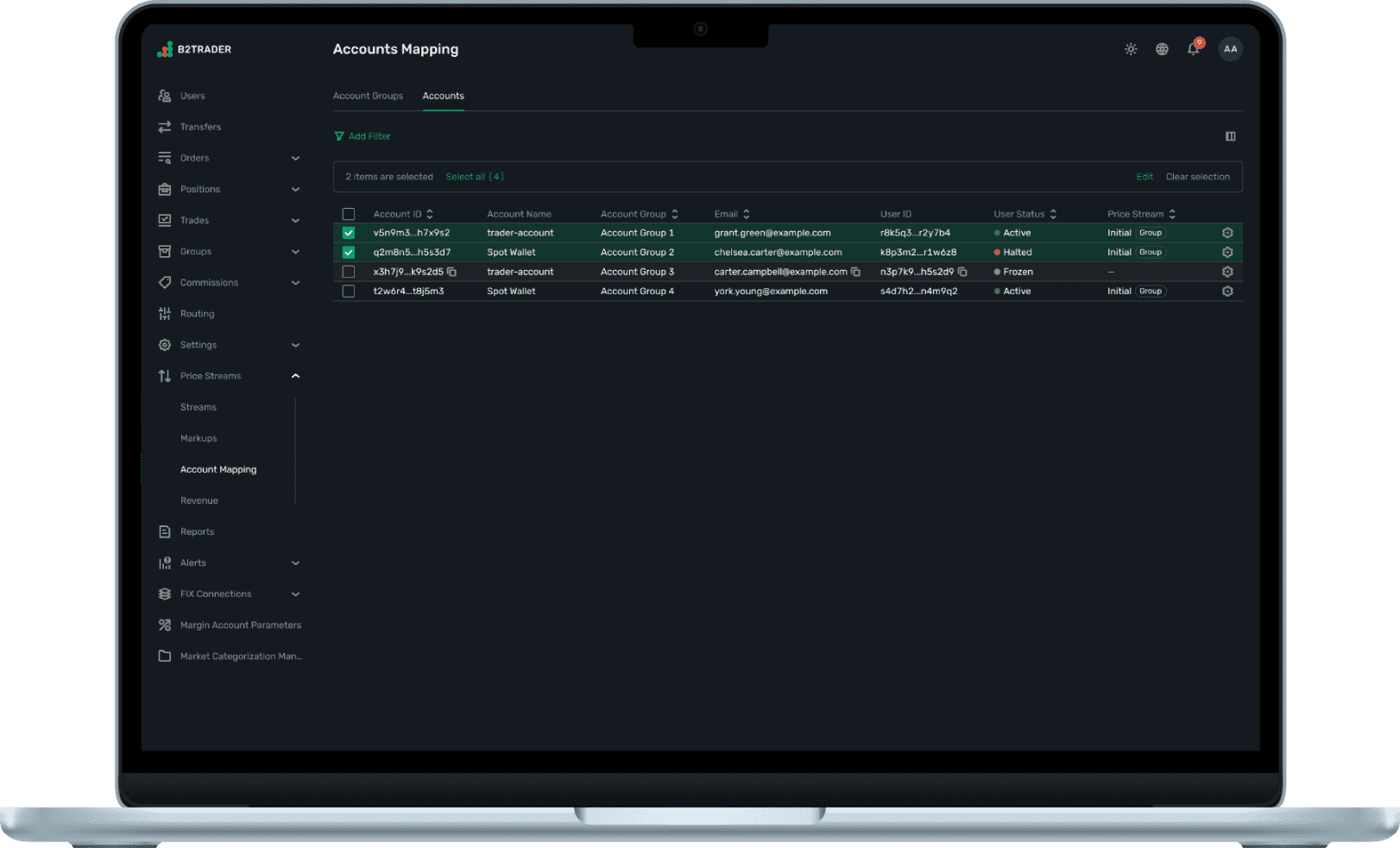

To Individual Accounts (Optional):

In the Accounts tab, repeat the process used for account groups.

Bulk actions are also supported for individual accounts.

Additional benefit for you and convenience for your customers

Flexible Price Streams

Create and manage multiple price streams for different markets, ensuring tailored pricing.

Flexible Price Streams

Create and manage multiple price streams for different markets, ensuring tailored pricing.

Flexible Price Streams

Create and manage multiple price streams for different markets, ensuring tailored pricing.

Markup Types

Apply markups as either a percentage or a point value, affecting the bid and ask prices.

Markup Types

Apply markups as either a percentage or a point value, affecting the bid and ask prices.

Markup Types

Apply markups as either a percentage or a point value, affecting the bid and ask prices.

Visibility Controls

Choose which markets are visible to traders, adding flexibility to market offerings.

Visibility Controls

Choose which markets are visible to traders, adding flexibility to market offerings.

Visibility Controls

Choose which markets are visible to traders, adding flexibility to market offerings.

Increased Profitability

Adjusting markups allows to enhance profit margins on market activities.

Increased Profitability

Adjusting markups allows to enhance profit margins on market activities.

Increased Profitability

Adjusting markups allows to enhance profit margins on market activities.

Strategic Pricing

Tailor pricing strategies to market conditions or specific client segments using differentiated price streams.

Strategic Pricing

Tailor pricing strategies to market conditions or specific client segments using differentiated price streams.

Strategic Pricing

Tailor pricing strategies to market conditions or specific client segments using differentiated price streams.

Enhanced Market Positioning

Offering competitive pricing can attract more traders and improve market share.

Enhanced Market Positioning

Offering competitive pricing can attract more traders and improve market share.

Enhanced Market Positioning

Offering competitive pricing can attract more traders and improve market share.

Operational Flexibility

Configurable markups provide flexible responses to changing market dynamics or business goals.

Operational Flexibility

Configurable markups provide flexible responses to changing market dynamics or business goals.

Operational Flexibility

Configurable markups provide flexible responses to changing market dynamics or business goals.

Liquidity Flexibility

Combination of the Markup functionality with different liquidity providers allows to create unique trading proposal inside the platform

Liquidity Flexibility

Combination of the Markup functionality with different liquidity providers allows to create unique trading proposal inside the platform

Liquidity Flexibility

Combination of the Markup functionality with different liquidity providers allows to create unique trading proposal inside the platform

FREQUENTLY ASKED QUESTIONS

What are markups in trading?

Markups modify the prices offered to traders from the prices received from liquidity providers, either as a percentage or specific point value, affecting the bid and ask.

What are markups in trading?

Markups modify the prices offered to traders from the prices received from liquidity providers, either as a percentage or specific point value, affecting the bid and ask.

What are markups in trading?

Markups modify the prices offered to traders from the prices received from liquidity providers, either as a percentage or specific point value, affecting the bid and ask.