Essentials for Brokers

Order Books

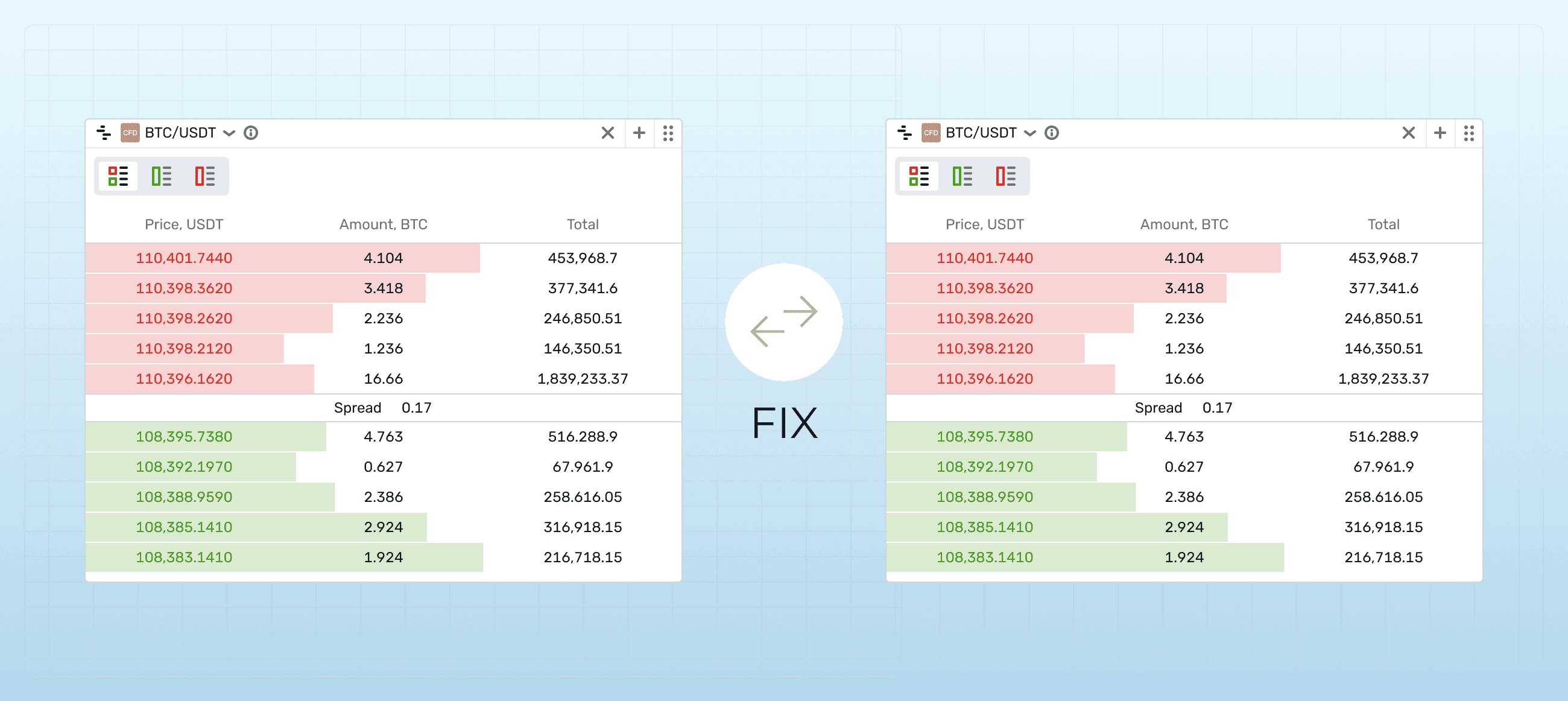

The Order Books module in B2TRADER operates with two distinctly managed books: internal and external. This dual-book system allows efficient order management and execution based on the chosen A/C-Book or B-Book model.

or

The internal order book handles orders placed within the B2TRADER, while external orders interact with liquidity providers under specific conditions. This system streamlines order processing, keeps traders’ activities transparent, and efficiently manages interactions with liquidity providers.

Vladimir Moshkov

Product Manager